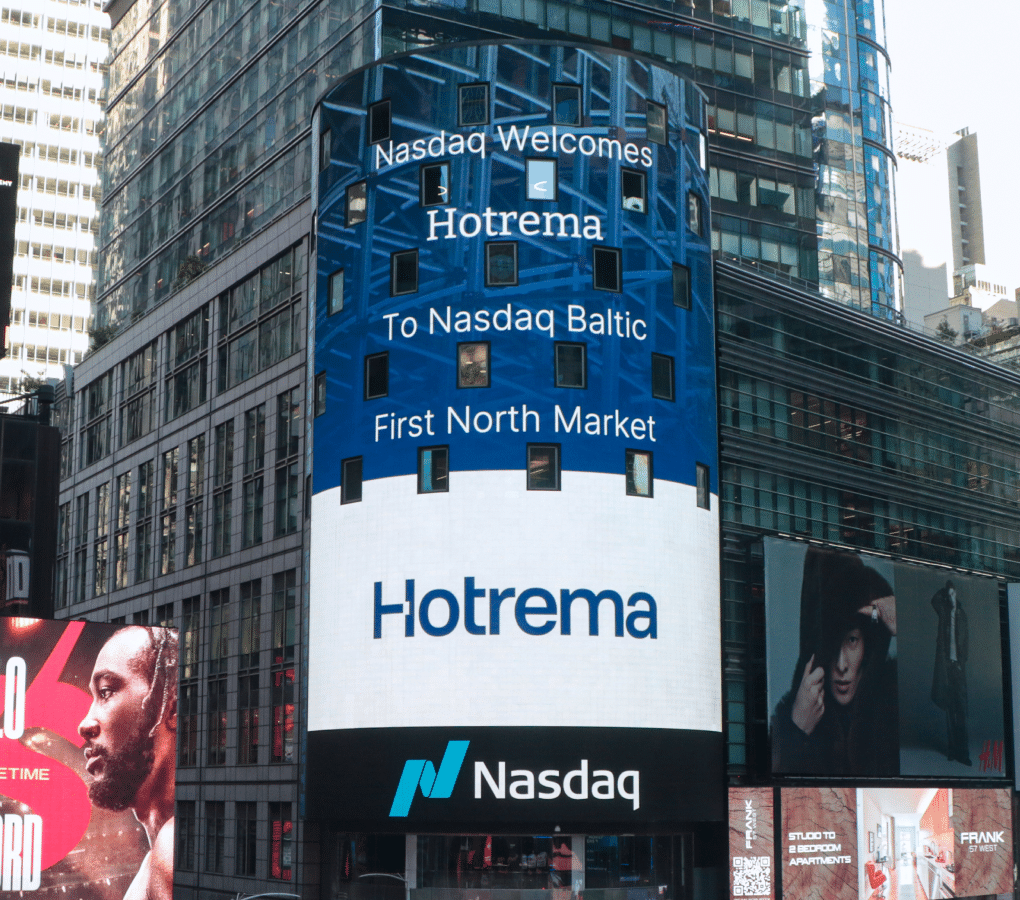

On 19 September 2025, the Nasdaq Vilnius stock exchange admitted Hotrema’s issued bonds for trading on the Nasdaq Baltic First North market.

Through a public bond offering in Lithuania, the industrial insulation and scaffolding systems installation group Hotrema raised more than EUR 5 million. Each bond has a nominal value of EUR 1,000, with an annual interest rate of 9%, paid quarterly The bonds have a maturity of 2 years and 10 months, with a redemption date of 25 April 2028.

The issuance attracted strong interest from both retail and institutional investors, with demand exceeding supply. Initially, the company planned to raise a smaller amount, but due to active participation from investors, the final amount exceeded EUR 5 million. In total, 423 investors purchased the bonds, 76% of whom were retail investors from Lithuania, Latvia, and Estonia. The average invested amount reached approximately EUR 11,800.

The bonds were distributed by AB Artea Bank, the issuer’s certified adviser is the law firm Norkus ir partneriai COBALT, and the bondholders’ trustee is Audifina.

“This step by Hotrema into the First North market is a great example of how the Baltic capital market is becoming increasingly attractive to growing companies. We are pleased to contribute to this stage and believe that investor confidence will help Hotrema further strengthen its position in the energy, industrial, and infrastructure project services sector,” Gediminas Varnas, President of Nasdaq Vilnius, says.

“The successful placement of the bond issue and entry into the First North market marks an important stage in Hotrema’s growth. We thank investors for their strong interest, which demonstrates trust in our vision and capabilities. This support gives us even more determination to expand internationally and continue growing Hotrema as a reliable partner for both clients and investors,” Marius Lazdauskas, Hotrema’s CEO and shareholder, adds.